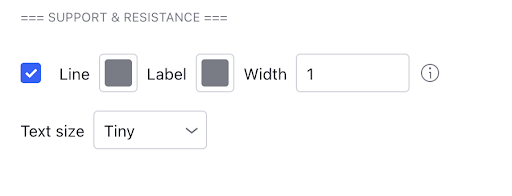

Support And Resistance

There are lots of ways of deciding how to mark up support and resistance, we like to use ATR values related to daily price action. Marking levels up on lower timeframes tend not to give such good levels to play whereas calculating values from the Higher time frames gives us levels we know are more like to be respected.

Although they are calculated from the daily timeframe you will notice these levels will adjust to the daily price action to make sure they are keeping up to date on levels you need to keep an eye on.

Example

Here we see price has pushed above the resistance level, we can either wait for it to close above this level and try long it to the next resistance level or see if it gets rejected and closes below giving us a short opportunity.

Price closed above giving us a target of the next level which it ends up hitting and getting rejected off, potential short opportunity.

Plays out perfectly ... .

If the levels move whilst you are in a trade we would recommend exiting the trade or bringing your stop to entry if possible. Unless you have added confluence which confirms your idea should still be intact. If this is the case you could use the new levels as potential targets.

Alerts

Not currently available